Spendable Remittances That Move in Seconds and Work on Arrival

Every year, hundreds of billions of dollars are sent across borders. These payments are lifelines for families, support systems for communities, and essential income for workers across the world. In 2024, global remittance flows hit a record $905 billion.

These payments are critical, yet the system that supports them still runs on outdated rails, riddled with delays, fees, and friction points.

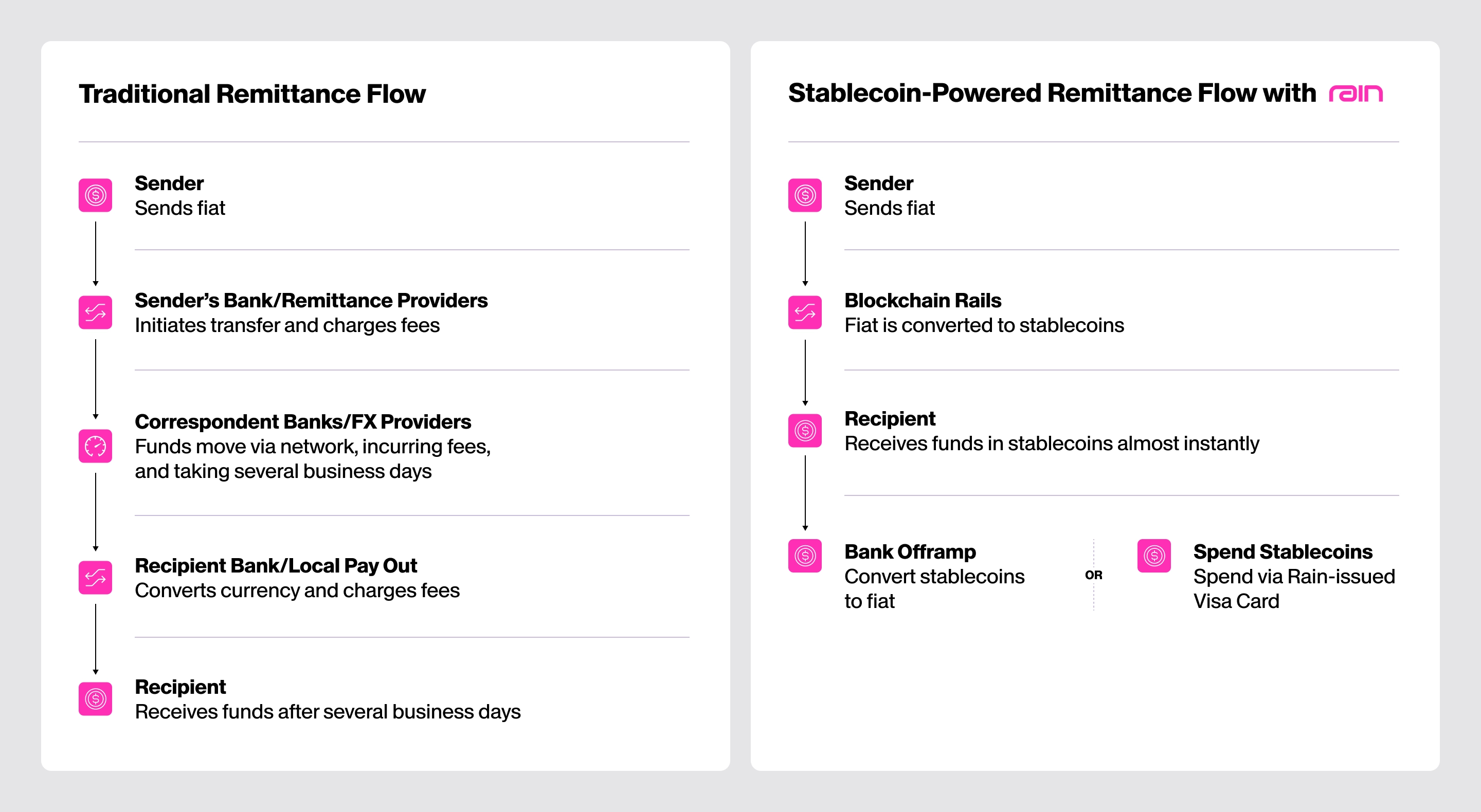

Stablecoins offer a clear solution. They reduce costs, settle instantly, and allow money to move over programmable, borderless infrastructure. They’re not limited to banking hours, and unlike traditional rails, don’t rely on a patchwork of third-party intermediaries.

Stablecoins upgrade the infrastructure, but the assets have to be spendable to provide real utility for users. That’s where Rain comes in.

Why stablecoins are changing the game

For remittance providers, stablecoin rails offer a meaningful upgrade to the economics, operations, and reach of the business.

Traditional remittance models require managing float across multiple banking partners, currency corridors, and regulatory zones. That means maintaining costly pre-funded accounts, coordinating with correspondent banks, and building out complex treasury infrastructure, all while navigating volatile FX markets.

Rain offers remittance platforms a simpler path forward:

- Lower treasury and liquidity costs

Stablecoins reduce the need for capital to sit idle across dozens of local accounts. On-demand funding and real-time settlement optimize float and unlock working capital. - Reduce cross-border settlement costs

Stablecoin rails eliminate intermediaries and costly banking hops. That means fewer layers of fees, faster reconciliation, and less friction with local payout partners. - Capture more of the FX spread

Instead of absorbing unfavorable exchange rates or relying on third parties for conversion, remittance platforms can execute FX when and where it makes the most sense. That leads to better margins and more control. - Reach new markets without legacy infrastructure

Stablecoins open up corridors that are underserved by traditional banks. With Rain, remittance providers can launch in more regions without building new local bank relationships or opening physical branches.

Rain helps platforms integrate this shift without the lift. With one stack, you get programmable stablecoin flows, integrated compliance, Visa card issuance, and on and offramps that work across cash, bank, or wallet endpoints.

A better model: spendable remittances

Even when money moves fast, the last mile still slows people down. Recipients often wait on conversions, navigate across payout apps, or visit physical agents to access their funds.

That’s a real problem, especially when people need to cover urgent expenses like rent, groceries, or transportation.

Rain fixes the last mile. Our infrastructure turns remittances into ready-to-spend value. By moving funds onchain, senders avoid the high fees and unfavorable exchange rates that come with most traditional remittance systems. That means no hidden FX mark‑ups, lower transfer costs, and substantially more value reaching the recipient.

The process with Rain is simple: funds are onramped into stablecoins, stored securely in a wallet, and made instantly usable via a Rain-issued Visa card accepted by more than 150 million merchants worldwide.

No extra steps. No waiting. Just real-world utility, available instantly.

Here’s how Rain’s stablecoin-powered alternative compares to legacy rails:

From remittance to real spend: Rain x Zar

Across Asia, Africa, and Latin America, cash still drives the economy. People rely on networks of corner shops, airtime vendors, and mobile money agents to move everyday value. In 2024, over $1.6 trillion flowed through mobile money accounts via 28 million registered agents.

Zar is helping modernize the system. Through their platform, users in Pakistan can receive remittances from abroad directly in stablecoins, providing consumers with faster settlement, dollar stability, and lower fees compared to legacy remittance methods.

But access to digital dollars is only part of the solution.

With Rain, those stablecoins become immediately usable. Zar users can link their wallet to a Rain-issued Visa card and spend their funds right away. No offramps. No waiting.

Zar is expanding access for the unbanked. Users can visit a participating corner shop, hand over physical cash, and have it converted into stablecoins, deposited directly into the same wallet they use to receive remittances. This gives people a way to store value in dollars, even without a bank account.

Together, Rain and Zar deliver something the industry has long struggled to achieve: a remittance experience that actually works on arrival.

The full circle: onramps, spendability, and offramps

Rain has always supported the full value loop, from fiat onramps and onchain transfers to instant card-based spend. Now, we’re unlocking a new layer of global access: cash pickup through Western Union.

With our new integration into the Western Union Digital Asset Network, users can now convert stablecoin balances into local currency and pick up physical cash at thousands of Western Union locations worldwide, making remittance payments more flexible and accessible.

Whether someone prefers to tap a Rain-issued card or walk away with cash, it all happens from a single wallet.

With Rain, you get:

- Fiat onramps via ACH, wire, or SWIFT with conversion to stablecoins and funding to an enterprise wallet.

- Wallet infrastructure to store, manage, and access stablecoins.

- Programmable cross‑border transfers via API, with real‑time status and rich metadata for audit and reconciliation.

- Immediate spendability through Rain‑issued physical and virtual cards that your recipients can use anywhere Visa is accepted, reaching 150M+ merchant locations globally.

- Local‑currency offramps to bank accounts when cash settlement is required.

- Flexible custody models (custodial or non‑custodial) to match recipient preferences and your risk posture.

- Integrated compliance (KYC/AML) embedded in the end-to-end flow.

The bottom line

Remittances should be fast, cost-effective, and ready to use the moment they land. Rain makes that possible.

By removing friction at the point of use, Rain gives recipients instant access to funds and enables remittance providers and payout platforms to move money more efficiently from send to spend.

Ready to modernize your cross-border infrastructure and unlock new value for your users and your business? Let's talk.